Coronavirus Trading Risk Management

The world market has seen an unprecedented downturn over the last few months, all because of the coronavirus. Stock markets, commodities, and currencies alike have all been drastically affected by the coronavirus pandemic. Many people are panicking as they watch their investments tank, but people, panic is not the right way to approach this situation.

Although the coronavirus is certainly not a boon to traders and investors, just because things don’t look so good right now does not mean that you cannot make money. If you invest and trade the right way, you follow certain rules, and you allow your mind to do the work, instead of your emotions, you could walk away from the coronavirus pandemic in relatively good condition.

A lot of this has to do with risk management. If you manage to efficiently control risk while trading and investing during this coronavirus pandemic, you could make some decent profits. Right now, we want to cover some essential coronavirus trading risk management tips to keep your finances relatively safe. Here we have some great tips and strategies on how to preserve your capital and come out the other side of this coronavirus pandemic unscathed.

Decrease Lot Sizes & Investment Amounts

Something that you need to know when it comes to trading during the coronavirus pandemic is that you should decrease your overall level of risk. If you were investing 5% of your total per trade before the coronavirus pandemic, at this time, you might want to decrease this amount. Most people would recommend trading with no more than 1% to 2% of your total capital per trade.

This way, you will still have the opportunity to make a profit, but if a trade goes south, you won’t lose a huge amount of money. Simply put, due to volatility and uncertainty, you should decrease the amount of money you risk per trade, and in other words, never trade with more money than you can comfortably afford to lose.

Close Your Trades Over Night

Something else that you should do for proper risk management during the coronavirus pandemic is to close your positions overnight. Of course, this does not apply to your stocks and commodities investments, but it is very important for Forex traders.

The market is so volatile right now, that if you keep Forex positions open during the night, you may wake up in the morning to find that your trades have tanked. Therefore, sticking to short term trades and closing your positions at the end of each day before you head off to bed is a good idea.

Pay Attention to Safe Haven Currencies & Assets

When it comes to trading and investing risk management during this coronavirus pandemic, another good idea is to pay attention to safe haven currencies and safe haven assets. In terms of currencies, the United States Dollar, the Swiss Franc, and the Japanese Yen are all considered safe haven currencies.

There are currencies people flock to during times of economic turmoil. Therefore, paying close attention to these is vital for successful Forex trading. Also, pay attention to defensive stocks and gold as well, as both are considered safe havens. A good idea may be to also invest in safe government bonds.

Take Advantage of Short Positions

In terms of coronavirus risk management for trading, in order to still make money even in markets with strong bearish trends, taking advantage of short positions is crucial. Of course, when you open a short position, it means that you expect the price of something to go down. This is a good way to trade in a bearish or downward trending market. Remember, prices don’t have to go up for you to make money.

Remember the Laws of Supply & Demand

Yet another coronavirus risk management tip to follow is that you should always pay attention to the laws of supply and demand. In other words, in times like this, there are certain products and currencies that decrease in demand.

For instance, many commodities have decreased in price due to low demand, something that can definitely be said for the hospitality industry. The point here is that there are certain assets and securities which rise in demand in times like this, and others which decrease in demand. The higher the demand compared to the supply, the higher the price will be.

Stop Panicking & Start Thinking

Perhaps the worst thing that you could do while trading and investing during this coronavirus pandemic is to panic. This applies particularly to panic selling. As the coronavirus hit, people began panic sell mass amounts of stocks and commodities, which caused prices to tank.

Well, the market functions in a cyclical fashion, which means that even if it moves down for a long time, eventually it should recover and bounce back.

Sure, selling assets that are predicted to tank and to never recover is one thing, but selling off all of your assets that may very well bounce back and become stronger than ever is very short sighted. Remember, as an investor, you need to focus on long term goals, not the short term.

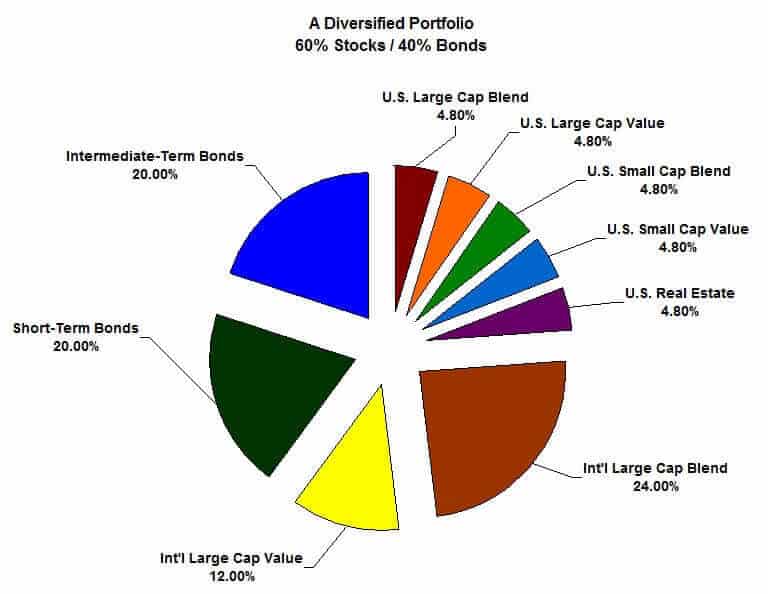

Diversify Your Investment & Trading Portfolio

Yet another risk management strategy for this COVID-19 pandemic to put to use is portfolio diversification. The fact is that if you put all of your eggs in one basket, and that basket breaks, you lose all of your eggs. So instead of just investing in one thing, invest in and trade multiple asset types. This way, if one fails, you still have the others to fall back on.

Use Stop Loss & Take Profit Orders Properly

Using stop loss and take profit orders properly is also another good way to manage risk during this uncertain time. Using trailing stop losses is going to be one of your best weapons to prevent excessive losses in this super volatile time.

Coronavirus Trading & Investing Risk Management

There you have it folks, some really good risk management tips for trading and investing during this tough time of the coronavirus pandemic.