Investing & Trading During COVID-19

Investing & Trading During COVID-19

The sad thing is that although things like this have happened before, none of us were prepared for the COVID-19 outbreak. COVID-19 managed to ravage the world in a matter of mere weeks, and a large part of this has to do with the economy. Of course, the health and wellbeing of millions of people worldwide has been affected in a negative way. However, poor health is not the only effect of the COVID-19 pandemic.

Worldwide, economies have virtually collapsed, especially in particular sectors such as hospitality, travel and tourism, gambling, and so many other sectors too. For all of you traders and investors out there, whether you trade Forex or invest in the stock market, this COVID-19 fueled worldwide economic meltdown has had serious consequences. For example, the USA unemployment rate is at a record high, with conditions not having been this severe since the 2008 economic crisis.

The trading and investing landscape have changed quite a bit since the pandemic started. If you are a stock investor or Forex trader, chances are that you have been hit pretty hard and suffered some losses.

However, this is not to say that it is not possible for traders and investors to come out of the COVID-19 pandemic unscathed, and even with some profits too. Today, we are here to provide you with some crucial tips on investing and trading during COVID-19. With these tips, not only can you save yourself from going belly-up, but you might just increase your capital holdings too.

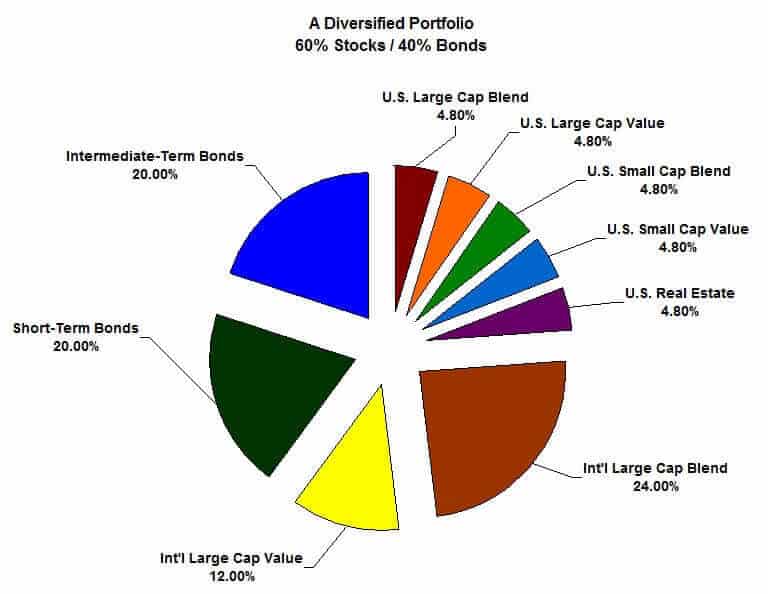

Keep Diversification in Mind

Something that has spelled doom for so many traders and investors, due to this COVID-19 pandemic, is having all of their money tied up in a single or just a few market sectors. Folks, this is something that you should have already been doing, but now at this time, diversifying your investments and trades is more important than ever.

In other words, don’t put all of your eggs in the same basket, because if one market sector crashes due to the effects of the pandemic, you will lose all of your money.

It’s a good idea to diversify, to invest some money in various Forex currency pairs, to invest in some commodities, some stocks, and in government bonds too. This way, if one of your trades or investments tanks, you still have many others to make up for the losses.

Using the Right Trading and Investment Services During COVID-19

If you are an avid Forex trader, chances are that you are using a high quality broker. If you are a stock investor, you probably have a broker doing most of the work for you. The point here is that high quality brokerages cost a lot of money, particularly in terms of trading and investing commissions.

Now, we are not saying that you should kick your broker to the curb, but that said, you do need to evaluate how well the broker is performing for you in comparison to the fees you are paying. If the fees alone are eating up most of the profits that you could have made, then it might be time to change things up. Using low commission brokers can go a long way in saving you money during this uncertain time brought on by the COVID-19 pandemic.

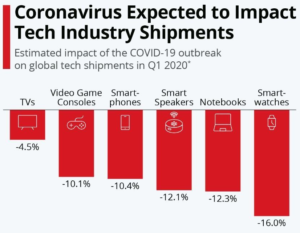

Educate Yourself on the Impact of COVID-19

Something that you definitely need to do, more now than ever, is to monitor the markets, economies, and individual industries. Of course, the way in which you trade and invest money depends on market conditions.

Well, COVID-19 has destroyed many sectors, with hospitality being one such example. Moreover, some national currencies are weathering the storm very well, while others have been decimated. Therefore, in order for you to weather the storm, and maybe even to make a profit, you need to educate yourself on exactly how COVID-19 is affecting various industries, markets, and currencies.

With the right analysis tools, you can predict the trends in various market sectors to make more informed trading and investment decisions. Make no mistake about it, COVID-19 has had a massive impact on the finance sector and on economies in general.

Decrease Your Risk

One of the biggest tips that you can follow about investing and trading during this COVID-19 pandemic is to decrease your risk. Now, here we are talking specifically about trading. If you were trading with 5% of your capital per trade before the pandemic, now you should be trading with 1% or 2% of your capital per trade at most.

The fact of the matter is that you absolutely cannot be trading with money that you cannot afford to lose.

Moreover, trading might need to take a little backseat at this time. COVID-19 has seen many people lose their livelihoods. Therefore, it might be a good idea to put a portion of your money into a savings account and to keep it for a rainy day. Having all of your money tied up in trades and investments during this time is not recommended.

Focus on High Demand Areas

Another good tip that we can give you for trading and investing during COVID-19 is to focus on high demand markets. Sure, some market sectors have crumbled due to COVID-19, but there are others which are still in high demand.

For instance, the medical industry is booming, oil is always a good investment, and there are various national currencies which are seen as safe haven currencies. If you want to make money, you need to invest into market areas which are still seeing a high demand. Remember folks, pandemic or not, the law of supply and demand still holds true.

Investing During COVID-19 – Final Thoughts

The bottom line is that during the COVID-19 pandemic, you do really need to rethink the way you trade and invest. If you follow the tips we have outlined today, you might just be able to come out of this pandemic in better shape than when it all began.