Trading Lessons You Need to Learn

Trading Lessons You Need to Learn

If you are a newbie trader then there are so many different things that you need to learn in order to be successful. This is true whether you are day trading, swing, trading or anything in between. And it also applies to all trading types, whether we’re talking about crypto currencies, forex, the stock market or commodities, the fact of the matter is that there are various trading lessons that you need to learn early on in your trading journey in order to be profitable.

Of course, as is the case when we first started trading, we also needed to learn these lessons and unfortunately we had to learn the hard way. Luckily for you, we already learned all of these trading lessons the hard way, so now we can convey all of this information to you so you don’t have to learn the hard way. If you read this article on the best trading lessons that you need to learn, then you can avoid making the same mistakes that all too many beginners make.

Trading Lessons for Success

What we want to do right now is to cover some of the most crucial trading lessons for success that you need to know in order to make money instead of lose it.

Consistency is Key

One of the biggest trading lessons that you will learn eventually is that consistency is key. Now what many beginner traders do is to choose one type of trading strategy or one type of indicator and then use that as much as possible. Now beginner traders will often win a couple of trades but then lose many more than they win.

Most traders will then move on to a different trading strategy because they think that the previous one didn’t work. Most traders will bounce back and forth between various trading strategies in the hopes that something awesome is going to come along people. The fact of the matter is that the trading strategies aren’t the problems.

Let’s face it, when you choose a trading strategy, you look it up online and you are going to use one that everyone else says is proven to work. This means that most trading strategies that you will utilize do actually work. The problem isn’t the trading strategies. The problem is you. You need to be consistent. Inconsistencies will lead to inconsistent wins and losses. Master a single trading strategy, make sure that it works and then if you like, move onto another one.

https://www.youtube.com/watch?v=v8SijCI0ZTU

Your Strategy Needs to Have an Edge Over the Market

When it comes to the most valuable trading lessons that you need to learn. Although being consistent is of course very important, what you also need to realize is that you always have to have an edge over the market. The simple explanation here is that whatever trading strategy you choose to use over the long run, it needs to be profitable.

Or in other words, it needs to produce a positive result. The fact of the matter is that no matter how consistent you are, if your trading strategy does not produce a positive result in the long run, then you are going to end up consistently losing money.

Of course, in this sense, consistency is not a good thing. Now what you need to realize here is that it is possible to have an edge over the market with a low winning rate because your average gain is still at much higher than your average loss. But it is also possible to have an edge over the market if you have a higher loss than gain ratio because you’re winning rate is very high. Either way, you need to have an edge over the market and this is one of the most valuable trading lessons that we wish we knew when we first started trading.

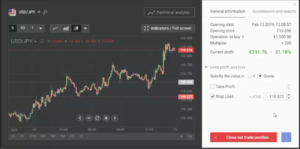

Just Follow the Price

Yet another one of the biggest trading lessons that you need to learn as a newbie trader is that it’s usually best if you follow the price. If you don’t know how to do analysis or you just don’t have time to crunch all of those numbers, then what you should do is to follow the price.

If the price is moving higher, you should place buy trades and if the price is moving lower, you should place sell trades. Another piece of advice that you should follow is to always pay attention to the price no matter the fundamentals. Therefore, if you see that the price is going up, but you think that there might be a bearish reversal in the horizon, you should still follow the price, especially as a newbie trader.

https://www.youtube.com/watch?v=wCzUI1hys_E

There is No One Size Fits All Strategy

In terms of valuable trading lessons that you need to learn as a newbie, this one is perhaps the most important. The fact of the matter is that many traders think that there is some kind of one size fits all trading strategy which some people refer to as the Holy Grail. Sure, it’s some trading strategies are much better than others. This is true.

However, the fact of the matter is that every market is different, and every type of trading is different too. This means that a trading strategy that works well for Forex swing trading is probably not going to work well for cryptocurrency day trading. Each trading strategy is specifically designed for specific markets, and the sooner you figure this out, the better you will perform.

It’s Not a Get Rich Quick Scheme

The next of the Super valuable trading lessons that you need to learn is that trading is not a get rich quick scheme, but in fact is a get rich slow scheme. You can easily grow your trading account to 7 figures or even eight figures, but it does take a long time.

The fact of the matter is that slow trading, or in other words, placing many small investments, is much better than placing just a small amount of big trades in the hopes of making it big.

Sure, you could win a whole lot of money in a limited amount of time, but as soon as you lose a single big trade, the journey is over. Therefore, what you want to do is to take the slow approach, because if you engage in proper risk management, your chances of winning trades are much higher. It’s much better to make slow profits than it is to lose money. It’s as simple as that.

Trading Lessons for Newbies

The bottom line here is that if you pay attention to the various trading lessons that we have provided you with here today, your chances of becoming a profitable and consistent trader increased greatly. Remember folks, these are lessons that we wish we knew when we first started trading. Luckily for you, you can get right past making the errors and get right to trading the proper way.

If you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.