Learn Stocks with Stock Trading Mentor Box

Learn Stocks with Stock Trading Mentor Box

OFFICIAL LINK HERE

If you have been paying attention to the financial world, you probably know that there is a whole lot of movement and volatility out there. In terms of making money on the market, there is no better time to start trading the stock market than right now. With that being said, trading the stock market is not easy, it is intimidating, and it is quite risky too. If you don’t know what you are doing, chances are you will end up losing a whole lot of money. Well, this is where something like Stock Trading Mentor Box comes into play.

The fact of the matter is that trading the stock market is not simple. This is something that takes a whole lot of knowledge, skill, patience, the right mindset, and a lot of experience too. Of course, you have to start somewhere, so you can actually gain some experience. Well, one of the best places for any newbie to start is with a solid education. Whatever the case may be, whether stock market trading or anything else, if you have a good knowledge base, then the actual thing becomes much easier.

This is why we are here today, to talk about one of the best ways for you to get a stock market trading education, with Stock Trading Mentor Box. Now, Stock Trading Mentor Box is brand new, and it was just released, which is why we are here to do an initial review of it. From what we have gathered, and from what know about its creator, who also happens to be the mentor, this is set to be one of the best, easiest, and most informative stock market trading courses out there.

What is Stock Trading Mentor Box?

To give you a thorough explanation, Stock Trading Mentor Box is a brand new stock market trading course, a real school for aspiring stock market traders, so to speak. The simple fact here is that this is a full-length and comprehensive stock market trading course, one where you will learn practically everything that there is to know about trading the stock market.

Keep in mind, this is the real deal, a legit school that teaches you just as much as any university or college course out there.

This course is lead by a world-renowned trading expert who makes it both fun and easy to learn, not to mention quite profitable too.

Keep in mind that this school is 100% online, which is nice because it means that you can wake up in the morning, sit on your couch in your pajamas, and learn how to make money on your own time, from the comfort of your own home.

If you want an easy and fast way to master stock market trading, you’d be hard-pressed to find a better place than Stock Trading Mentor Box. It’s all about taking newbies who don’t know a single thing about the stock market, and turning them into self-sufficient, knowledgeable, and profitable stock market gurus.

Who can Benefit from it?

In case you are wondering whether or not Stock Trading Mentor Box is right for you, just ask yourself a single question. Do you want to find out how to make easy money trading stocks? If your answer to this question is yes, then chances are pretty big that this particular stock market trading academy is ideal for you.

Now, what does need to be said is that this course is of obviously designed for beginners and newbies, for people who really don’t know the first thing about the stock market and economics in general. This course starts off by teaching you all of the basic terms, concepts, and theories, and then moves on to teach you how to actually trade, how to read charts and graphs, how to use indicators, what good trading strategies consist of, and so much more.

Simply put, Stock Trading Mentor Box is designed to take newbies and turn them into pros by teaching them everything there is to know. That said, this course is also designed to be very easy to follow. Everything is done in video format, with the instructor explaining everything verbally and through live or realtime video examples. This means that newbies can see all of these concepts and strategies live in action, which makes it much easier to follow along.

Of course, this however does not mean that seasoned stock market traders could not a learn a thing or two from Stock Trading Mentor Box. It comes packed with so much information, and there are always new developments, that even the most seasoned of trading veterans could probably stand to gain some valuable insights from this stock market trading academy.

Who is the Teacher?

Seeing as you might trust Stock Trading Mentor Box to teach you all of the necessary skills to be successful, you probably want to know who the person is that you will actually be learning from. The teacher who you will be learning from is none other than long time trading expert Andrew. A.

Andrew has been in the business for many years now, well over a decade, and in that time, he has managed to achieve massive success trading Forex, crypto, stocks, and more. Sure, Andrew is a great stock market trader, but he can do so much more than that, which is exactly what makes him such a great person to learn from, and also because he has made all of the big mistakes in his past, and he has learned from them.

This means that you can avoid making those same mistakes right from the beginning. There is also the fact that Andrew makes learning easy. With Stock Trading Mentor Box, all lessons come in the form of videos, with Andrew explaining everything slowly, thoroughly, and in simple terms, along with his live video examples. The fact that you have someone both telling and showing you how it’s done is a pretty big deal.

VISIT ANDREW’S TRADING CHANNEL

Now, if you think that you recognize Andrew, chances are that you probably do. This is because this is the same Andrew as from Andrew’s Trading Channel on YouTube, a free resource where Andrew has uploaded literally thousands of trading tutorials. If you want to check him out, so you can get a feel for his teaching style, check out his YouTube channel.

That said, you may also recognize Andrew from the Income Mentor Box Day Trading Academy, a trading school that focuses on Forex. Income Mentor Box has been around for a few years now, it has helped thousands of people become profitable Forex traders, and it has rave reviews. Seeing as Andrew’s Forex academy has done so well, there is no reason to think that this stock market trading school won’t be just as good.

A Peak at the Stock Trading Mentor Box Curriculum

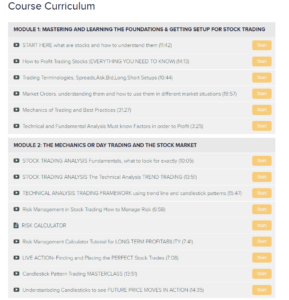

Now you probably want to know what the Stock Trading Mentor Box course will actually teach you. Well, this course consists of over 50 full length video tutorials, and here you will learn everything from basic terms to some of the most advanced trading strategies out there. Let’s get to it and take a sneak peak at just some of the materials that you will have access to with Stock Trading Mentor Box.

- Eliminating Risk – One of the lessons or concepts that you will have access to here is all about eliminating risk. Of course, risk is an inherent part of stock market trading, but here you will learn how to eliminate it as much as possible.

- Saving Time and Making Money – Stock trading can take a lot of time, which you probably don’t have to spare. At Stock Trading Mentor Box, you will learn how to make maximum profits with minimal wasted time.

- Finding Out What Type of Trader You Are – There are many types of traders and styles of trading out there. Depending on what type of trader you are, you need to stick to certain types of trading. This is exactly what you will learn here.

- Controlling Your Emotions – The fact of the matter is that emotions have no place in stock market trading. Emotions do nothing but get in the way. Stock Mentor Box will teach you how to ignore your heart and focus on your brain.

- Andrew’s Best Trading Strategies – One of the best things that you will learn here are all of Andrews’s personal favorite and most profitable trading strategies.

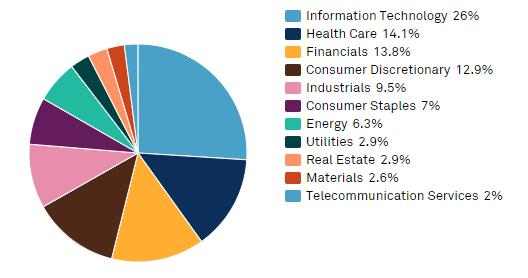

- Analytics – In order to be a proficient stock market trader, you first need to know how to analyze the market in-depth, which is another thing that you will learn from Stock Trading Mentor Box.

- Indicators and Scanners – Indicators and scanners are a huge part of trading, and here you will become intimately familiar with them.

- AND MUCH MORE – Don’t forget that there are over 50 full-length lessons here, so there is plenty more for you to learn.

The Five Goals of Stock Trading Mentor Box

We talked about the Stock Trading Mentor Box curriculum, but what about its goals? There are five main goals of this stock trading school, so let’s take a quick look.

To Teach You the Best Stock Trading Strategies

One of the primary goals of Stock Trading Mentor Box is to teach you all of the best stock market trading strategies known to man, and some than only Andrew knows. Like we mentioned before, here you will learn some of the best trading strategies out there, ones that Andrew has either perfected or created himself.

To Teach You what the Right Trading Mindset is

Having the right mindset is super important when it comes to stock market trading. If you don’t have the right mindset, right from the beginning, then things definitely won’t go your way. You need to be able to set realistic goals, you need to be calm, rational, and analytical, and you need to ensure that you stay on track. Moreover, being able to deal with loss is another thing that Stock Trading Mentor Box will teach you.

To Teach You Trading Discipline

Another simple fact that is stock market trading requires a heck of a lot of discipline. You need to be able to put together a comprehensive trading plan based on fact and analysis, and you need to stick to that plan. Discipline is half the battle.

To Teach You how to maintain Constant Growth

Another goal of Stock Trading Mentor Box is to teach you how to keep growing, and this is meant both in terms of knowledge and money. It’s all about constantly learning more, becoming better, and increasing your profit margins. If you aren’t progressing, you’re regressing, and no one wants that.

To Help You Overcome Obstacles and Achieve Success

Finally, perhaps the most important goal of all that Stock Trading Mentor Box helps you achieve is that of success. People, there will always be obstacles and hurdles in your way, but you need to fight through them. With the experience and knowledge you gain from this course, your chances of success will increase drastically.

The Free Stock Trading Ebook

What is really cool about Stock Trading Mentor Box, when you become a member, it’s not just the course curriculum that you get access to. When you become a member, you automatically get a free stock market trading Ebook.

This Ebook is a great introduction to the world of trading in general, and it has some nifty stock market trading tips too. It introduces you to topics and concepts such as graphing and charting, indicators, support and resistance, candlesticks, and more. Of course, you do want to take the full course to really become a stock trading expert, but this complementary book makes for a great starting point.

The Free UPSI Indicator

Not only does Stock Trading Mentor Box come with a free trading Ebook, but it also comes with a free indicator included. Now, this indicator is brand new, it is state of the art, and it was just created. The fact that you get an advanced, easy-to-use, and super functional stock market trading indicator included for free is a pretty big bonus as far as we are concerned.

The UPSI indicator was actually created by, yeah, you guess it, Andrew and his team of expert analysts, traders, and coders. This is a never before seen indicator that can help aspiring traders make the right decisions.

This indicator is all about providing you with accurate and profitable BUY/SELL signals, and it even provides you with exit points too. It’s more or less a full-fledged signals service for stocks. It’s super easy to use and it make it easy to profit on a daily basis without really having to do much work.

Cost and Membership Information

Seeing as we are talking about trading and making money, something you probably want to know is how much this whole affair is going to cost you. Well, the total cost of Stock Trading Mentor Box is a very reasonable $399. People, just to be clear, this is a one-time payment, and that’s it. There are no hidden, secret, additional, or recurring fees of any sort.

Once you pay the $399, you become a member for life. And yes, you heard that right, when you join Stock Trading Mentor Box, that single payment grants you unlimited and lifetime access to all course materials. There is also the fact that making $400 in a single day of stock market trading is easily done, well, at least if you know what you are doing.

It is also worth noting that in terms of the price, you won’t find anything better than the Stock Trading Mentor Box course. $399 might sound like a lot, but if you really examine the situation and shop around a bit, you will quickly realize that this is in fact one of the most affordable options out there, if not the number one most affordable.

Stock Trading Mentor Box Review – The Verdict

At the end of the day, if you want to become a successful and profitable stock market trader, there is no better place to learn than Stock Trading Mentor Box. The fact of the matter is that this is the most cost-effective stock market trading course out there, especially when compared to the massive value and education that you get. You simply won’t find more education for a lower price out there.

Here you will learn everything from the basics and the fundamentals all the way to the most advanced and complex aspects of stock market trading. You’ll learn the secrets that the pros don’t want you to know, you will learn how to analyze the market fast and with accuracy, and you will learn how to execute the most profitable trades to put money in your pocket. When it comes down to it, there is no better place for newbies to learn how to be a real stock market trading guru.