Ultimate Profit Scalping Indicator Version Two

Ultimate Profit Scalping Indicator Version Two

If you are sick and tired of losing money trading cryptocurrencies, the stock market, forex, and more, then you have come to the right place. Today, we want to take a closer look at the Ultimate Profit Scalping Indicator version two. Now, this is a brand new type of indicator that was just released not too long ago. With that being said, the Ultimate Profit Scalping Indicator or UPSI has been around for a couple of years now.

This particular indicator already had rave reviews because it did work very well. It was very efficient at providing users with profitable buy and sell signals based on trends and more. However, this indicator, the UPSI, has since then been upgraded.

This is now the Ultimate Profit Scalping Indicator version two. This is a state-of-the-art indicator that is going to help put money in your pockets through a variety of means. Although it might sound like this is just a simple indicator with one component, there are actually seven different components included with this one indicator, all of which are going to help you make money in one way or another. Let’s take a closer look at this Ultimate Profit Scalping Indicator version two to see exactly what it can do for you.

The Ultimate Profit Scalping Indicator Version Two

Right now, we want to take a closer look at this brand new Ultimate Profit Scalping Indicator version two. First and foremost, if you are wondering whether or not this indicator is right for you, chances are that it probably is. The simple fact of the matter is that this is an all-in-one indicator that is going to provide you with all the tools and knowledge you need to place profitable trades.

Unlike with other indicators where you might need three, four, or even five of them, right here you just need this one single indicator. This is a really big bonus, because it helps to avoid confusion. The fact of the matter is that when you use other indicators, when you have to use multiple indicators at once, things get really confusing. You just have way too much to pay attention to when you are using more than one indicator.

Well, here, you never have to use more than one indicator. The Ultimate Profit Scalping Indicator version two does all of the work for you and it is an all-in-one indicator that will provide you with financial opportunities on all time frames and on all assets. Yes, that is right, this is another big bonus of the Ultimate Profit Scalping Indicator version two, the fact that it works for all assets and on all time frames.

You can use it on the shortest one minute time frames and on super long one day time frames. It also works on forex, cryptocurrencies, stock market assets, and everything in between. This is what we mean when we say that the Ultimate Profit Scalping Indicator version two is an all-in-one indicator. It works for virtually everything and anything that you could possibly trade.

The Components of UPSI V2

What do you need to know now is that there are actually seven main components of the Ultimate Profit Scalping Indicator version two. So, let’s take a quick look at each of these seven components to see exactly what you get with UPSIV2.

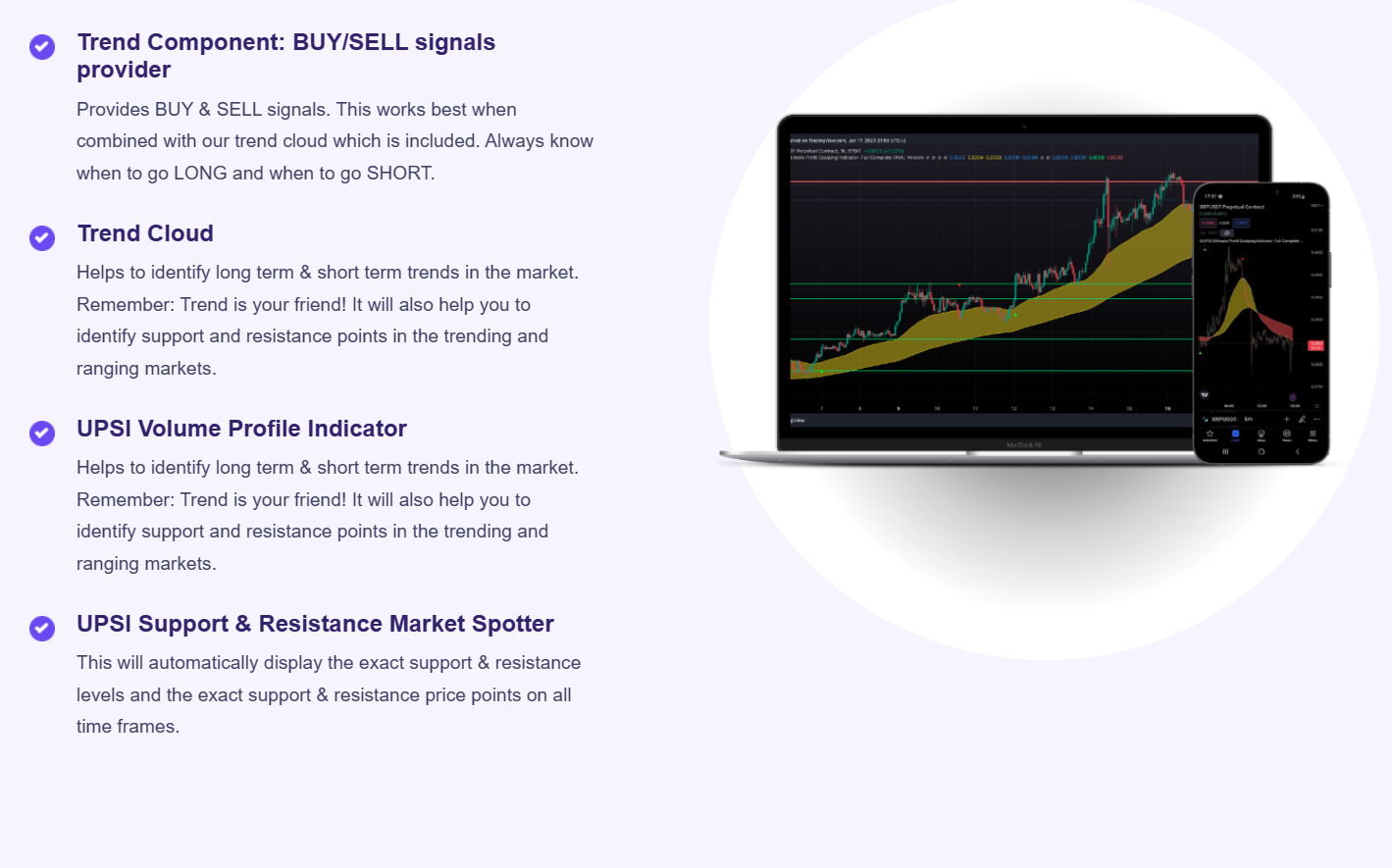

The Trend Component

The first component of the Ultimate Profit Scalping Indicator version two is the trend component. The trend component is going to provide you with profitable buy and sell signals. This component works best when it is combined with the UPSI trend cloud, the next feature we are going to look at. This particular feature is going to tell you when you need to go short and when you need to go long.

The Trend Cloud

The second component is the trend cloud component, and this is going to help you identify both short term and long term trends. It’s also going to help provide you with resistance and support points in both ranging and trending markets.

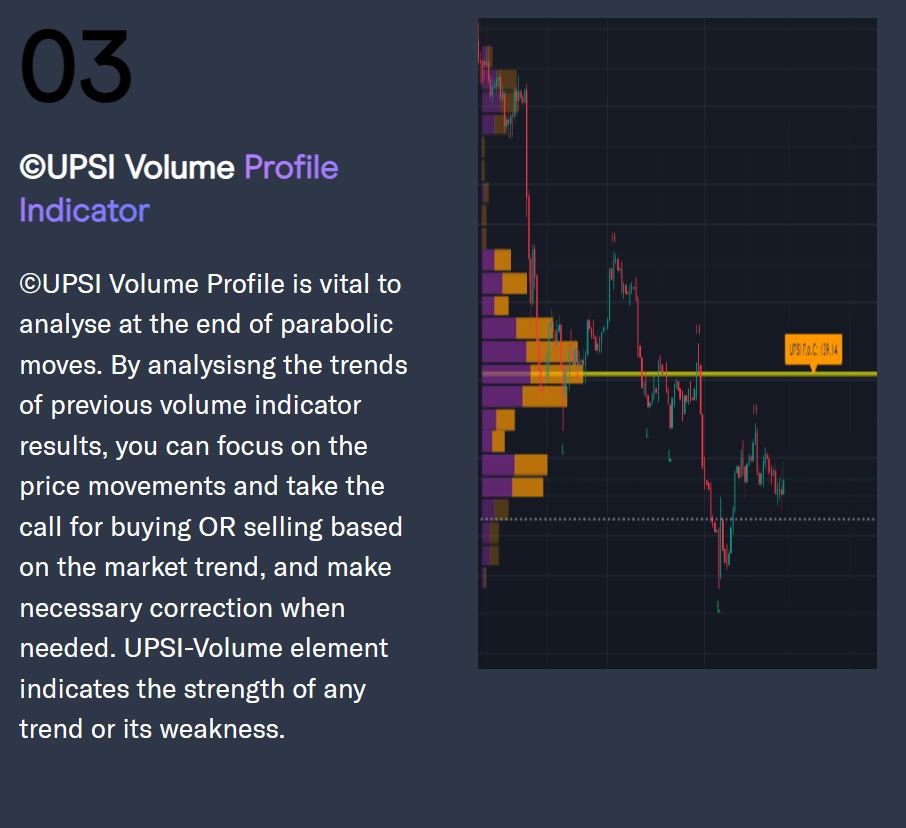

The Volume Profile Indicator

We then have the UPSI volume profile indicator which helps you analyze parabolic moves. in simplest terms, this volume element indicates the strength of any trend or its weakness.

The UPSI Support and Resistance Spotter

The fourth component is the UPSI support and resistance market spotter which helps to display exact support and resistance levels, as well as support and resistance price points for all time frames. Yes, that is right, it works on all time frames. It also helps you find the best take profit and stop loss levels, and it also shows you swing high and swing low price zones.

The Support and Resistance Scalper

the 5th component is the support and resistance scalper. If the price falls below a support level, it becomes resistance, and vice versa. This is exactly what this particular portion of the indicator can tell you.

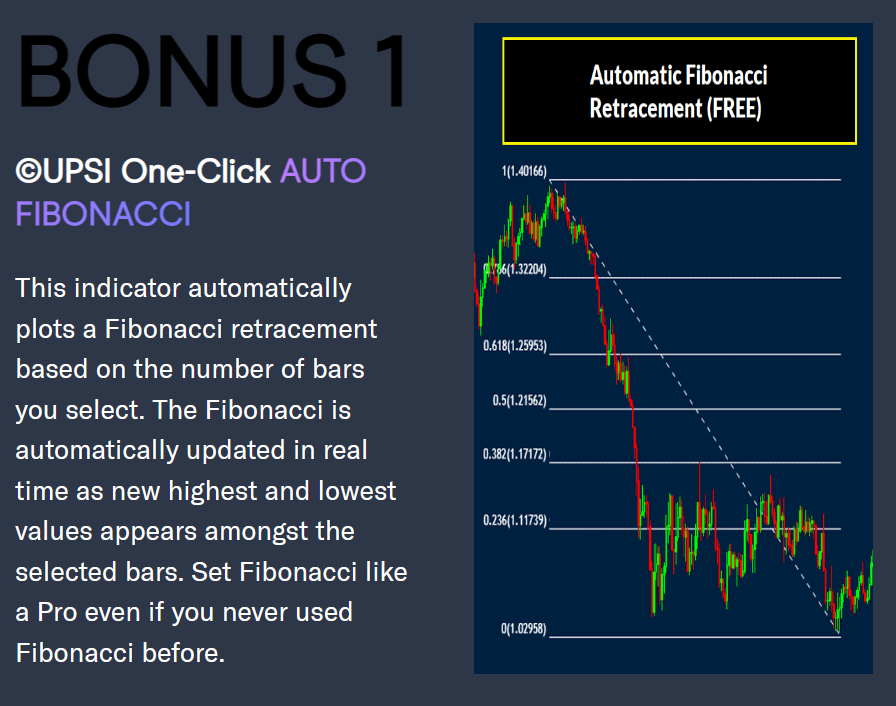

Auto Fibonacci

The 6th component, also known as the first bonus component, of the Ultimate Profit Scalping Indicator version 2, is the auto Fibonacci retracement. This indicator will automatically plot a Fibonacci retracement based on the number of bars that you have selected, and the dollars updates in real time as the lowest and highest values appear amongst the selected bars.

The Automatic Triangle, Wedge, and Flag Spotter

Technical traders often use flag, triangle, and wedge patterns to identify potential trend continuations or reversals. This particular indicator is going to show you when any of these patterns happen. This means that you can easily trade in all types of markets without much trouble.

The Ultimate Profit Scalping Indicator Version Two – Final Thoughts

When it comes down to it, the Ultimate Profit Scalping Indicator V2 is one of the best tools that you’re disposal if you plan on making money. It works on all assets, whether forex, cryptocurrencies, or the stock market, and it works on all time frames. It is by far one of the best indicators that you could possibly use, so we definitely recommend giving it a shot.