Best Indicators for Swing Trading

Best Indicators for Swing Trading

If you want to become a profitable trader, then one of the things that you need to master are the different types of trading. Of course, day trading is one of the most popular type of trading out there which involves placing trades that generally only last for a single day. Now the type of trading that we are here to talk about today is swing trading. In case you have no idea what swing trading is, no worries because we will explain this below in great detail.

Now what we are really here to do today is to talk about the best indicators for swing trading. In case you don’t know what indicators are no worries, because this is something else that we will explain today. The bottom line is that you do need indicators in order to be a profitable trader, and this goes for all types of trading. Whether we are talking by day trading or swing trading. Let’s get right to it and figure out what swing trading is, what indicators are, and what the best swing trading indicators out there are at this time.

So, What is Swing Trading?

OK so I’m like day trading that generally sees trades only being open for a single day. So in trading is a much longer type of trading. Or in other words, trades can last anywhere from a couple of days up to a few months. As you can see, this is a much longer term type of trading that generally involves buying low and selling high.

The aim is to buy a stock asset or security as low as possible and then sell it as high as possible for maximum profits. Of course, these huge profits is something that many people are attracted to. But with that being said, swing trading does leave you vulnerable to overnight and weekend risk. However, the bottom line here is that swing trading can of course be extremely profitable.

What’s an Indicator?

Something else that you need to know here is what an indicator is. For those of you who don’t know, an indicator in trading are statistics that are used to measure current market conditions as well as to forecast future economic trends and financial conditions. When it comes to trading and investing, indicators usually always refer to specific technical charge patterns derived from the price, volume, or open interest of a given security.

Technically speaking, there are four different types of indicators out there, and they all provide you with different types of information. The four different types of indicators out there are volume, momentum, trend, and volatility indicators. These are all important pieces of information that traders should be aware of when it comes to placing profitable trades. Of course, with that being said, what we are here to talk about today is what the best indicators for swing trading are.

Some Swing Trading Indicator Criteria

Before we take a look at the best swing trading indicators out there, we do want to provide you with some criteria that will help you choose the best indicators for this type of trading.

- One of the most important factors to lookout for when choosing an indicator for swing trading is that it is actually easy to understand. These are tools that you need to be able to understand in order to make profitable trades, so if you can’t understand what is going on, then it is a useless indicator. In other words, you need indicators that are simple.

- Yet another thing to lookout for here when choosing an indicator for swing trading is that you want to use indicators that provide you with different types of information. The more pieces of information an indicator can tell you, the less indicators you need to have open, and this makes things less confusing. Generally speaking, you want indicators that can do three things at the same time, which include determining your entries, determining how you will take profits, and determining your stop loss.

- The other thing to lookout for here is that you get swing trading indicators that are free to use. There are plenty of free indicators, so there is no point in paying for anything.

The Best Indicators for Swing Trading

Alright, so now that we have figured out what swing trading is, what indicators are and how to choose the best indicators for swing trading. Let’s figure out what the actual three best indicators for swing trading are.

The Zig Zag

If you need an indicator that can help you determine the market structure and will instantly plotted out for you. Then the zigzag indicator is a great one to consider. This indicator works by plotting points on a chart. Whenever a price reverses by a percentage that is greater than the pre chosen variable. This is a great indicator for identifying price trends and it helps to eliminate random price fluctuations and attempts to show trend changes. With that being said, this is an indicator that you want to use in conjunction with price action.

Donchian Channel

Specific indicator is ideal for helping you to visualize both the lows and highs on your chart. Depending on the specific time period that you want to look at. It’s all about being able to determine the highest high and the lowest low over a certain amount of time. It’s a great indicator to use because it tells you where potential buy and sell trades are. As you can see on a chart, it looks a lot like a channel with the lower channel being a reference to buy and in upper channel being a reference to cell it’s almost like support and resistance. With that being said, using trending indicators such as moving averages in conjunction with this indicator is recommended.

OHLC

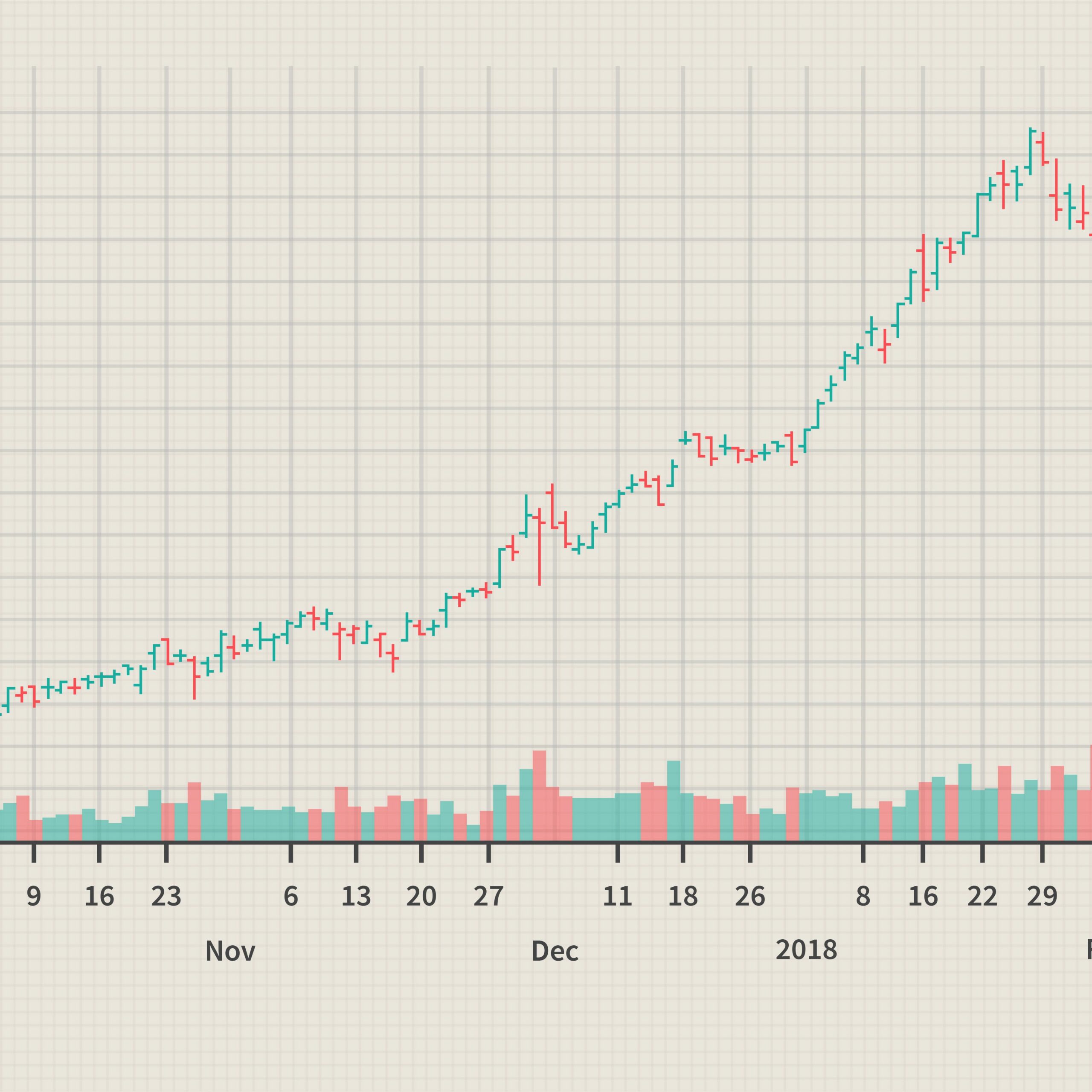

This stands for open high, low close, and it helps us to visualize the lows and highs of a daily candle no matter the time frame. When you see the price forming a bearish candle from the previous day’s highs, you can go short. On the other hand, when you see the price forming a bullish candle from the previous day’s lows, you can go long. This is an important indicator to use because it will provide you with information about trend reversals from daily highs and lows.

The Best Swing Trading Indicators – The Bottom Line

Now that you have a basic understanding of what swing trading is, as well as what indicators are plus how to choose the best indicators for swing trading, you should have no problems finding the best possible options for you. We have already listed three of the very best swing trading indicators out there, but there are of course more.

Remember folks, if you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.

/dotdash_Final_Top_Technical_Indicators_for_Rookie_Traders_Sep_2020-01-65454aefbc9042ef98df266def257fa3.jpg)

:max_bytes(150000):strip_icc()/ZigZag-5c643b96c9e77c0001566e88.png)