5 Tips to Improve Your Trading Results

5 Tips to Improve Your Trading Results

As a beginner trader, you might think that simply trading on a regular basis is enough to make you a great trader. Sure, there is a lot to learn, and you can certainly put in a lot of hours. However, just spending time around the markets and putting in the hours won’t necessarily improve you trading results or make you a great trader.

The simple reality is that if you are a losing trader, putting in more hours into trading will just result in greater losses. Constantly trading without learning the right skills and following the right methods will just help engrain bad trading habits too. To help improve you trading results, you need to make some deliberate choices, the right choices.

Today, we want to talk about the five most important tips to improve your trading results. As you are about to find out, these tips aren’t anything super groundbreaking, but the simple things are often the most important ones. If you want to improve your trading results, take a closer look at the tips that we have outlined below.

Tips to Improve Trading Results

Let’s now take a look at five important tips you need to adhere to in order to improve your trading results on a day to day basis.

Focus on Being in the Right Mindset

One of the most important things that you need to do to improve you trading results is to have the right trading mindset. This means that you need to be present in the moment, focuses, and have a clear head. Also, make sure that you are focused on trading 100%. This means that you aren’t answering emails or going on social medial in the middle of trading.

You need to visualize your trading plan in your head, then execute it to the fullest of your abilities. Another good idea to make sure that you are well prepared for a day of trading is to go check the economic calendar to see if there are any big events or news releases. Big surprises and unexpected events can throw a wrench into the gears and really affect your mindset.

The bottom line is that your trading results are never going to improve if you aren’t focuses, and if you are upset, angry, or are even avoiding trading. Remember folks, it takes a single bad trade on a single bad day to wipe out your trading account. Everybody is different, but you need to find a way to relax and to achieve mental clarity before you start trading on any given day.

Get Some Assistance

If you want to improve your trading results, you should definitely try getting some help. The reality is that without someone in your corner to give you some discipline, trading becomes much harder. If you have someone that you are accountable to, then you won’t make as many lapses in judgment when trading.

You could go find yourself a trading coach or a mentor. Heck, the person you get assistance from doesn’t even have to be a trader.

Something you should try doing is to show someone your trading plan, and then your trading results. This type of accountability is often enough to keep traders in line. It helps prevent lapses in judgment, and therefore helps to improve overall trading results. To improve your trading results, you can also try going to some forums and asking professionals for feedback.

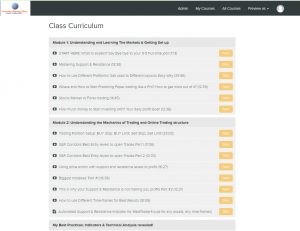

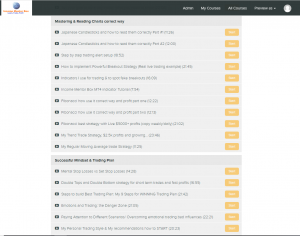

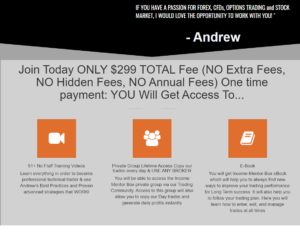

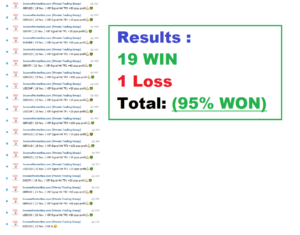

The bottom line is that if you can get help from an outside source, from people who can be objective, it’s going to help you out a lot. Of course, there are also many resources out there designed to help people learn how to trade. One of these resources is the Income Mentor Box Day Trading Academy, one of the best trading schools out there right now. If you have people to help teach you the skills you need to know to win trades, then it’s undoubtedly going to help improve your trading results.

Don’t Rely on Other’s Opinions

Ok, so we did say that getting outside help is a bonus, especially when it comes to a professional and dedicated educational source. Sure, discussing strategies and your performance with someone who knows what they are talking about is good too. However, something that you should avoid doing is asking other people’s opinions on specific trades.

You have your trading plan, and you need to trade your way. If another trader says that they will sell when you plan to buy, you need to follow your plan, not theirs. This is especially the case if you are employing a time tested and proving trading strategy that is shown to produce great trading results. Moreover, everyone trades differently, and you need to find out what works best for you.

You can’t keep changing your mind based on what forums, television, news, and other people say. This will do nothing but cause stress, you will start to doubt and second guess yourself, and this won’t help you improve your trading results at all. Put a lot of work and time into refining your own trading strategy, and don’t let someone else ruin it for you.

You Need to Put in the Practice

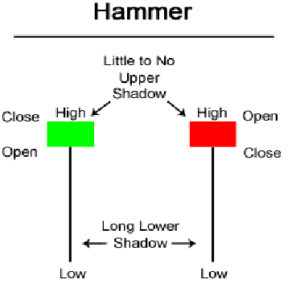

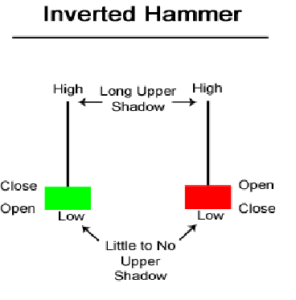

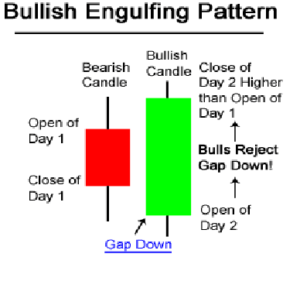

Yes, developing and refining your own trading strategy is vital to your success and your trading results. However, even easy newbie friendly trading strategies can be difficult to execute under live market conditions. Trends, pullbacks, and everything in between change on a daily basis. Yes, you have your textbook examples that you follow and base your trading on.

Yet, the live market is never going to look exactly like the examples. This means that to improve your trading results, you need to become better at thinking on the go and trading on the fly. You need to be able to adapt, improvise, and overcome.

To help make you a better trader, you want to take some proven trading strategies that you have refined to suit your style and strengths, and then practice it relentlessly. The best bay to do this is to use a demo trading account. This will allow you to trade under real market conditions, all without having to risk real money.

This way, you can endlessly practice, refine, and hone a strategy to the point where it will greatly benefit your overall trading results. It’s all about building muscle memory, developing the ability to improvise, and being able to make small adjustments for the market conditions on any given day. You want to learn the hard lessons in practice sessions, not when real money is on the line.

Record Your Trades & Analyze the Results

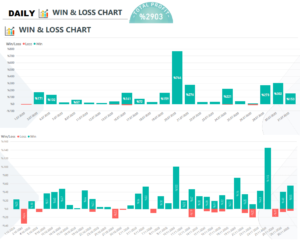

In order to improve your trading results in the future, perhaps one of the most important things you need to do is to analyze your past trading results, all of them. The best traders out there will record all relevant info from all trades, and even take screenshots.

You want to analyze what your trading results were like in terms of your stop loss levels, profit targets, entries, exits, and all of your analysis notes too. You want to be able to review this information at any time to see where you went wrong, or maybe even where you went right. A so called trading journal goes a long way because it can show you exactly what you did in certain market conditions, and what those trading results were like.

You want to review those trades on a weekly basis, and really put some time into analyzing what went wrong. If you review all of your trades side by side, you should be able to find the most common mistakes that you often make. If you can identify your common trading mistakes, it should go a long way in helping you improve your trading results.

Consistently Improving Your Trading Results

Folks, if you follow the tips that we discussed above, you should be able to consistently improve your trading results.

Make sure you are accountable to somebody, get help when needed, make sure you’ve got the right mindset, record all of your trades, analyze them for common mistakes, and more.

Remember, practice makes perfect, and using a demo account to practice trading is definitely something that can help improve your trading results. To get you started on the right foot, getting a trading education is definitely recommended.

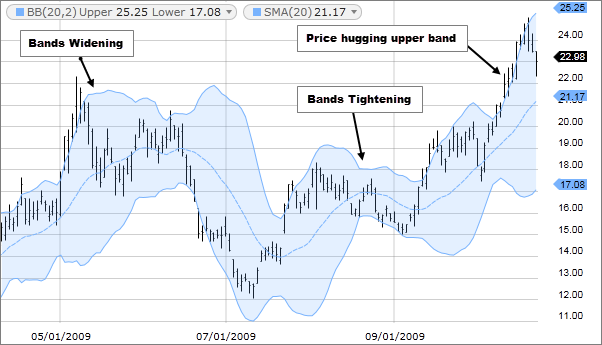

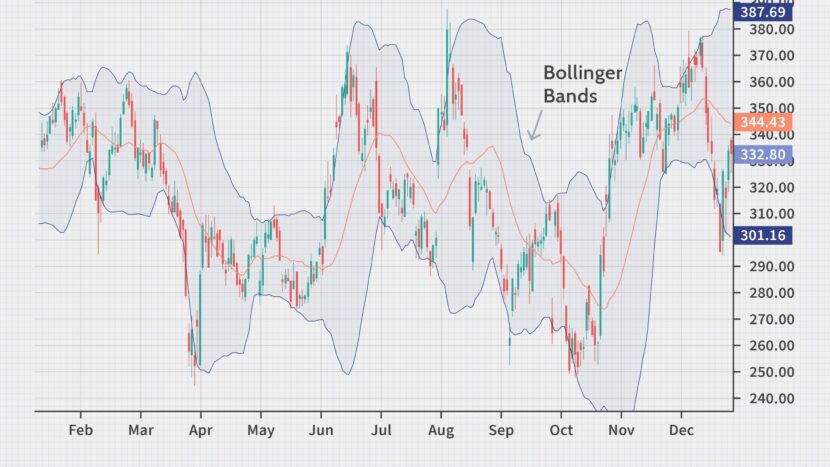

/dotdash_INV-final-Bollinger-Band-Definition-June-2021-01-518977e3031d405497003f1747a3c250.jpg)