Forex Trading Tips for Beginners

Forex Trading Tips for Beginners

If you are a beginner trader, then chances are that you are going to lose a lot of trades, especially if you don’t know what you are doing. The simple reality is that Forex trading is not easy. It takes a lot of practice, skill, and knowledge to be successful in the world of currency trading. This is what we are here for today, to provide you with the most important Forex trading tips for beginners that you need to know.

Now, make no mistake about it, because it is of course important to know all about indicators and proven trading strategies, but it goes deeper than that. Or in other words, there are so many simple tips that beginners can follow to increase their chances of success.

This is what we are here for today, to provide you with Forex trading tips that you can easily follow and adhere to as a beginner. These few simple tips that we are going to discuss should be more than enough to get you on the right track.

Forex Trading Tips – DO NOT DO THIS!

What we want to do first is to talk about the biggest mistakes that newbie traders make, the mistakes that lead to consistent losses. These Forex trading tips are things that all newbies need to avoid doing at all costs.

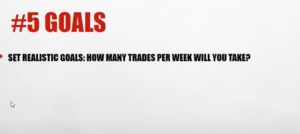

Do Not Overtrade

When it comes to important Forex trading tips for newbies, refraining yourself from overtrading is one of the biggest ones of all. The problem with overtrading is that you end up having way too much on the go at once. As a newbie, keeping track of one or two trades is already hard enough, let alone four or five trades. Overtrading and placing tons of trades gets you nowhere if you can’t win individual trades.

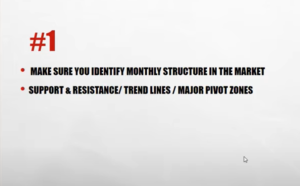

Do Not Use Lower Time Frames

Another big mistake that so many newbie traders make is using very low or short time frames for trading. Sure, short time frames are great for pros who know what they are doing and know how to make quick money. However, if you are a newbie trader, then using short time frames is very hard. The reason for this is because short time frames, those charts, they don’t provide you with much info. Placing trades based on just a few minutes of past price movements is not easy. When it comes to Forex trading tips for newbies, those short time frames just aren’t worth it.

Do Not Attempt to Trade the News

Another thing that you need to realize is that trading based off of fundamental news is not easy. Sure, fundamental news analysis is an effective way to trade, but that said, if you are not super familiar with exactly how news events are going to affect future price movements, then it is just not worth it. Judging what the market will do based on some news event is really difficult. Until you have the necessary experience, this is best stayed away from.

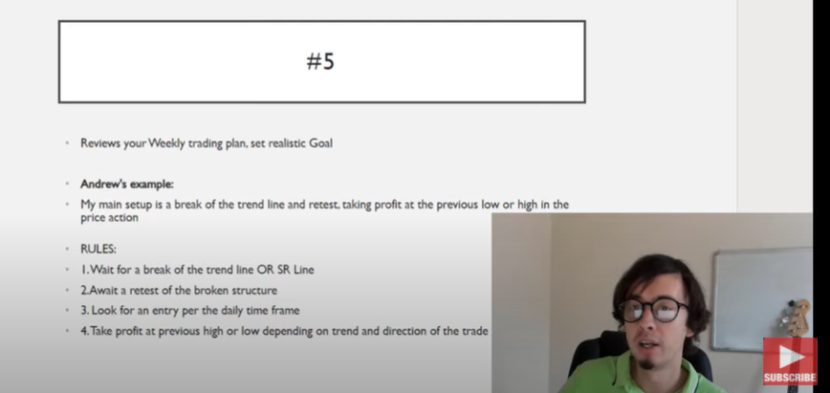

Do Not Overcomplicate Trading Analysis

In terms of important Forex trading tips for beginners, one of the biggest things to realize is that you don’t need to overcomplicate things. You don’t need to start using four indicators at once and you don’t need to try and trade like a pro. If you don’t have the skills to execute super complicated trading strategies, then don’t bother. There are plenty of simple trading strategies out there that will do the trick just fine.

Do Not Lose Money Consistently

One of the biggest mistakes that all too many newbies make is to just keep losing money and not doing anything about it. Folks, if the way you are trading is resulting in lost money time and time again, then don’t just keep doing it and think that something is going to change on its own. If you don’t change your approach then your results won’t change either. Doing the same thing over and over again, while expecting different results is called insanity.

Forex Trading Tips – Do This

Now that we have talked about all of the biggest mistakes that Forex newbies need to avoid, let’s talk about the biggest Forex trading tips in terms of the most important things that you need to do in order to profit.

Do Learn to Trade First

In terms of important Forex trading tips for beginners, perhaps the most important thing you need to do is to learn how to trade. Folks, this is not something that you can just start doing and be successful at. It just doesn’t work that way. You need a good education. If you want to learn to trade Forex, what we recommend doing is joining the Income Mentor Box Day Trading Academy. It is at this time the highest rated Forex trading school out there.

Do Use Longer Timeframes

Another important tip to follow here is to stick with longer time frames. Try using at least one hour time frames, and preferably even longer. Generally speaking, predicting future price movements is much easier when you have a longer period of past information to work with.

VISIT ANDREW’S TRADING CHANNEL

Do Practice Your Skills First

The other thing that you definitely need to do, perhaps the biggest of all the Forex trading tips for beginners, is to actually practice your skills using a demo account. There are plenty of platforms and brokers out there that allow people to trade with demo accounts. These are live market accounts that use fake money. This way, you can practice your skills under real conditions without having to put real money on the line.

Forex Trading for Beginners

Folks, if you follow all of the Forex trading tips for beginners that we have provided you with here today, your chances of becoming a profitable Forex trader increase drastically. If you take a look at the tips that we have discussed above, you can see that they aren’t anything super groundbreaking or revolutionary. However, tips as simple as these can make a huge difference when it comes to making a successful start in the world of foreign currency trading.

If you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.