Best Trading Guides for Beginners

Best Trading Guides for Beginners

If you are new to the world of day trading, whether Forex, stocks, crypto, or anything in between, you might be having a bit of difficulty. Yes, trading all of these assets on the market can be extremely profitable. For instance, if you do it right, you stand to make thousands of dollars per day. This is where the best trading guides for beginners come into play.

The fact of the matter is that trading something like Forex is much harder than just choosing random signals and executing trades. You need to have a lot of knowledge, skill, a good deal of patience, and yeah, a bit of luck too. However, if you go into trading without any prior knowledge or experience, you’re bound to lose money.

However, below we want to take a look at some of the best trading guides for beginners out there. All of these guides come to us courtesy of Andrew A. Andy is the leader of the Income Mentor Box Day Trading Academy, plus a large variety of other educational resources too. Today we are here to look at some of his most recent trading guides for newbies, as seen on his YouTube channel.

Best Timeframes for Beginners

One of the most recent trading guides which Andrew released on his channel is all about finding the best timeframes to trade in. Timeframes in FX trading are extremely important to know about. There are 1 minute, 3 minute, 5 minute, 15 minute, 1 hour, 1 day, and so many more timeframes.

Choosing the right ones can be very hard, especially as a newbie. Finding the right trading timeframes can make all of the difference. Check out the embedded video for a comprehensive explanation on choosing the right timeframes for day trading.

EUR/USD Scalping

This is another one of the best trading guides for newbies out there, with this one being all about Forex scalping, specifically using the EUR/USD pairing. Here you will find out all about scalping, what it is, how to do it, and more. In short, scalping in FX trading is all about placing a large quantity of small trades.

The aim is to make lots of small profits. It can be a great way for newbies to minimize risk and maximize profits. The EUR/USD pairing is one of the best to work with for FX scalping. If making lots of small profits each day sounds good to you, then you should absolutely check this video out.

SL & TP Masterclass

Just to be clear, SL stands for Stop Loss, and TP stands for Take Profit. Stop loss and take profit orders are essential to understand if you plan on being successful in Forex trading. Both SL & TP are vital if you plan on maximizing profits, mitigating risk, and minimizing losses.

A well set stop loss order can stop you from losing a full investment in the event that a trade goes south. Moreover, a well set take profit level can allow you to bank profits before things turn around. When it comes to trading guides for beginners, this might just be one of the first ones that you should check out.

Trading NASDAQ for Newbies

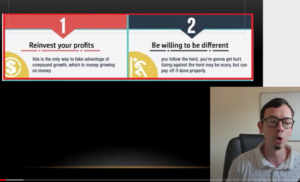

The NASDAQ is one of the world’s largest and most popular stock exchanges. Of course Forex is a great way to make money trading currencies. However, there are some really great profit opportunities on the stock market too. Now, trading the NASDAQ does take a bit of skill and knowledge.

This is not something you can start doing blindly. In this particular video, Andrew is going to show you how to use support and resistance levels to trade the NASDAQ. As you will see from this trading guide, Andrew manages to make somewhere in the neighborhood of $5,000 with this trading strategy. S&P500 for the NASDAQ tends to work quite well.

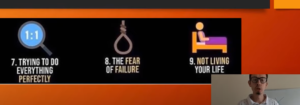

Stock Trading for Beginners

Yes, the previous trading guide was about trading NASDAQ stocks, but of course, there are other stock markets out there too, all of which can provide you with massive profits if you go about trading and investing the right way.

This particular trading guide will provide you with some of the very best stock trading tips out there. If you plan on getting into the stock market, before you do so, you should definitely check this video out. It will provide you with a whole lot of useful info to help get you started.

Generating Full Time Income from Home

What is really interesting about this particular trading guide is that it is all about being able to make profits from home. Some people have day jobs and trade Forex on the side, which is fine, but not necessary.

Real Forex traders can spend their days trading Forex and make more than enough money to live comfortably. It is not necessary to have a day job when you are a pro Forex trader. With this trading guide, you will get some really awesome tips on how to trade Forex full time from home. The point here is to bring you to a level where you don’t have to rely on a menial day job for survival.

Best Trading Guides for Newbies – Final Thoughts

As you can see, Andrew from Income Mentor Box has a great YouTube trading channel, one that comes out with many new videos per week, particularly these trading guides for newbies. Remember folks, nobody stumbles backwards into Forex trading and is an automatic success.

Life just doesn’t work that way. Becoming a professional and profitable day trader takes time and effort. That said, with these best trading guides for beginners, you can speed up the learning process a whole lot and start making good money much sooner.

Remember folks, if you want a truly comprehensive day trading education that covers everything from A to Z, then joining the Income Mentor Box Day Trading Academy is highly recommended.

LEARN TO DAY TRADE LIKE A PRO WITH INCOME MENTOR BOX!