Growing a Small Forex Account Fast

Growing a Small Forex Account Fast

If you are a newbie trader who is just getting into the world of forex, then chances are that you don’t have all that much money to start with. In other words you are starting out with a very small forex account.

Of course, when you start trading with such a small amount of money, say $100, then things are fairly difficult. When you start trading with such a small forex trading account, it can be extremely difficult to grow those profits to something substantial. Moreover, it with such a small forex account, it can also be extremely difficult to engage in proper risk management so you don’t lose all of your money.

The fact of the matter is that forex trading is not easy in the least, and it takes a lot of different skills, tools, and tips that you need to follow in order to be successful. What we are here to do today is to provide you with all of the most important tips on how to grow a small forex account fast.

Today, we are going to look at one specific video that Andrew has uploaded on his trading channel, Andrews Trading Channel. This particular video is all about the best tips and rules on how to grow a small forex account fast. Of course it’s not all about growing that account fast, but also about growing it reliably so you don’t lose money.

Growing a Small Forex Account: Three Stages

The fact here is that there are three separate stages that you need to follow in order to grow that small forex account fast and reliably. Let’s take a look at all three of these stages.

Stage 1

the first stage of growing a small forex trading account has to do with the types of trades that you place and how you trade. Let’s take a look at the biggest tips and rules that you need to follow within this stage in order to grow your small forex account fast.

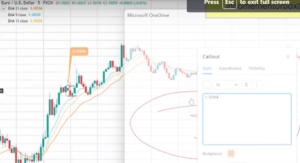

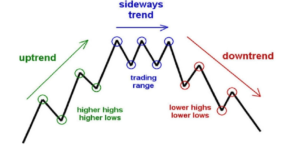

- One of the absolute most important rules that you need to follow here is to only trade strong trends. You need to be able to identify what trends are, and how strong various trends are. The point here is that you only want to place trades on very strong trends that are sure to continue in the same direction. as a beginner trader you should never place trades on weak trends, because the chances of things turning out profitably are very minimal if you do this.

- If you plan on growing your small forex trading account fast, what you always need to do is to take and lock your profits. In other words, don’t keep trades open forever in the hopes that they’re just going to keep profiting when they’re in the green. Profitable trades can and will eventually turn around and start losing money, and therefore it is important for you to take your profits whenever possible.

- In terms of how much money you invest into trades, if you want to grow a small forex trading account, you need to stick with very small investments per trade. In order to engage in proper risk management, it is recommended that you never invest more than 2% or 3% at most into a single trade. Moreover, you should also start with small lot sizes of 0.30 or lower. If you trade like this, even if you do end up losing a couple of trades, at least you engage in proper risk management, so you only lost a little bit of money.

Stage 2

Once you have mastered and followed all of the rules and tips that we talked about in the first step of growing a small forex account, what you need to do is to follow the next set of tips and rules that we are about to set out below. Although these tips are different from the first set that we provided you with, they are still extremely important for you to follow.

- First and foremost, one of the things that you need to realize about forex trading is that it is a marathon. This is a long term race, not a Sprint race that you need to villages quickly as possible. What we need to say here is that you need to set yourself realistic profit goals, because you aren’t going to make 100% ROI in a single week of trading. When you start with such limited trading capital as movies often do, making keeps profits on a weekly basis is just unrealistic, especially if you are just fine tuning your trading strategies. Your profit goal should be no more than 5% of your total trading account per week. This will help to ensure that you don’t get too overzealous with your trading, while still helping you stay motivated to make profits.

- In terms of how you trade, one of the absolutely most important things that you need to do is to only trade the most volatile of assets. Now, of course here we are talking about currency pairs, but this also goes for other types of trading, such as stock market trading. The fact of the matter is that the more volatile an asset is, the more movement it will see almost price charts, and therefore it makes it much easier for you to predict what is going on. The most volatile assets are those that see the most movement and therefore also provide you with the biggest profit potential.

- The other thing that you need to do in order to grow that small forex account quickly is to make sure that you use good stop loss levels. The thought of the matter is that most people don’t use adequate stop loss levels, and this means that even if they do have a stop loss level set, they usually end up losing way too much money before their trade hits that stop loss level and closes on its own. You should keep your stop loss levels very close, just below your original investment, therefore if you lose a trade, at least you won’t end up losing very much money.

Stage 3

Let’s now go over the final set of the most important rules and tips that you need to follow in order to grow your small forex account quickly and reliably.

- OK, so we did mention that you should be using take profit levels to take your and to lock them in. however, what happens if you have a winning trade, but it looks like it is going to reverse before it hits that take profit level? well, what you need to do here is to lock in your trades and close them early. If you see that a trade is in the green, but you think that it may reverse soon, and don’t wait for it to hit your take profit levels, because you want as much profit as possible. Therefore, you need to close trades early before they had to take profit level in the event that it looks as though they will reverse.

- The final tip that we have for you to follow here today when it comes to growing a small forex account fast, is that you always need to read the fundamentals and you always need to perform technical analysis on the major market movers. Now, we realize that fundamental and technical market analysis are extremely difficult to perform, especially as a newbie who doesn’t really know what they’re doing. However, with that being said you need to be able to perform both fundamental analysis and technical analysis, especially on the major market movers, if you plan on being successful. Therefore, we definitely recommend checking out some of the biggest and best indicators out there, and you should learn how to use them, so you can then analyze the market yourself.

- Although this particular tip was not included in Andrew video, we still do want to provide you with it, and this is that if you are a trading newbie who has no idea what you are doing, if you actually want to grow that small forex account fast, then you need to have an education under your belt. In other words you need to learn all about the best trading strategies and solutions out there so you can make as much money in as a limited amount of time as possible. This means that you should join some kind of trading school in order to learn everything that there is to know about forex trading so you can hit the ground running.

How to Grow a Small Forex Account

With all of the rules and tips that we have provided you with here today in terms of growing a small forex account fast, you should be able to do so in a relatively reliable manner. Just keep in mind that for the best results, you do want to have a forex trading education under your belt. It always helps to have a good foundation of knowledge before you start risking money on the market.

If you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.

/EMA-5c535d5a46e0fb000181fa56.png)

/figure-1.-eurusd-2-minute-56a22da35f9b58b7d0c78480.jpg)

/GettyImages-699097867-7277b42432f6473c9844a656d0014712.jpg)