Profiting with the EA Pip Scalper

Profiting with the EA Pip Scalper

If you are new to the world of Forex trading, or if you are having difficulties, you might want to check out the EA Pip Scalper app. You probably realize that Forex trading is not easy, mainly because there are so many different factors, aspects, and moving parts.

In order to be a successful currency trader, you need to have a great understanding of the market economy, indicators, oscillators, charts, and so much more.

If you don’t have a great knowledge base, trading currencies is super difficult. Moreover, even if you do have the necessary knowledge required to be successful in this type of trading, it’s still super time consuming. For professionals, currency trading is a full-time job, something that can consume up to ten or more hours per day.

This means that you might just not have the time to trade Forex, at least not in the quantities that would make sense for you. Well, this is exactly where the EA Pip Scalper Forex autotrader comes into play.

This is a popular and profitable automated trading app that trades FX currency pairs on your behalf. It does all of the hard work for you, so you barely have to do anything, all while making money. Today, we want to give you a rundown of what exactly the EA Pip Scalper app can do for your trading game.

Super User Friendly

Right off the bat, something that is very important to note about the EA Pip Scalper is that it is one of the most, if not the most user-friendly Forex trading app around. Seriously folks, the interface for this software is so easy that even a newborn monkey could use it.

There is really not much to it at all. Remember people, this is a 100% fully automated Forex trading app that does all of the heavy lifting for you. Using high-class algorithms and analysis methods, it performs all of the research and analysis required to produce profitable trading signals.

Yes, it then also executes those trades for you, complete with stop loss, take profits levels, and more. Simply put, you could turn this app on, walk away from it, go eat some dinner, and come back to your profits. When it comes down to it, this has to be the easiest to use Forex trading app around.

Designed for MetaTrader

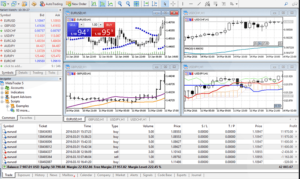

Another important thing to take note of is that the EA Pip Scalper system is not a freestanding piece of software, or in other words, it’s not its own trading platform. This piece of trading software is an add-on or extension that can be used with the highly popular MetaTrader trading platform.

For those of you who don’t know, MetaTrader is at this time the number one trading platform in the world.

To be specific, this app is designed to be used with either MetaTrader 4 or MetaTrader 5. That said, MetaTrader 5 is the much more functional of the two, and the EA Pip Scalper also works much better on MT5 than on MT4.

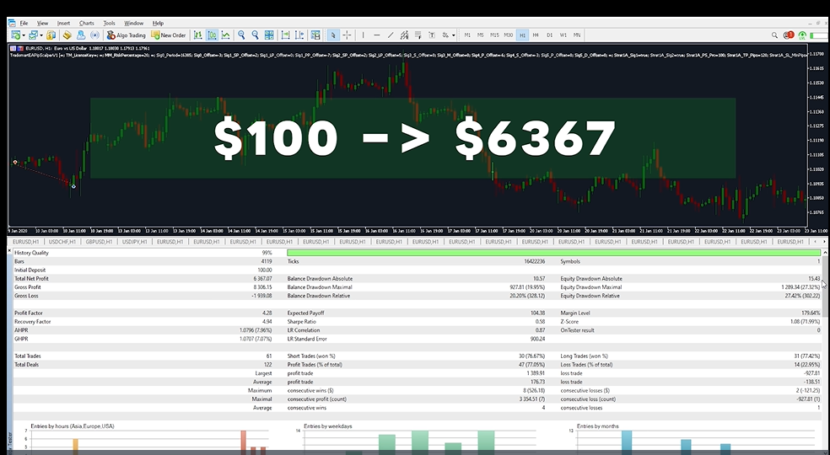

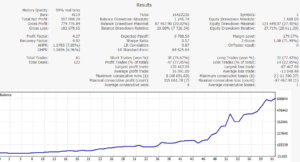

EA Pip Scalper Profitability & Accuracy

What you definitely want to know is how profitable and accurate the EA Pip Scalper is. After all, the main point of any piece of FX trading software like this is to produce profits and put money into your pockets.

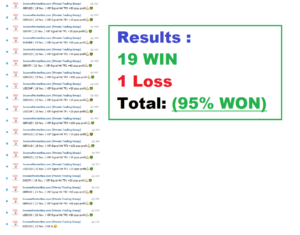

When this app is set to its default settings, it can produce win rates of up to 95%, with the average win rate being somewhere around 90%. Folks, this means that this software can win around 90 out of every 100 trades it places at the very least, and yes, that leads to some big time profits.

Installing the EA Pip Scalper

What’s kind of funny is the hardest aspect of using the EA Pip Scalper is installing it. The installation process will take about 15 or 20 minutes, and there are quite a few fairly complex steps that you need to follow. That said, the creators have made a very easy to follow installation guide, plus there is a step-by-step installation video guide available as well, which we have included below.

Returning to Default Settings

One issue that people seem to be having with the EA Pip Scalper app is returning to the default settings once settings have been changed. We aren’t saying that you can’t mess with the settings in an attempt to produce better results.

However, the default settings are optimized for the best results, and if you change the settings, you will eventually want to go back to the defaults. Follow this guide on how to return to the default settings.

Profitable Custom Settings for the EA Pip Scalper

Something that is cool about the EA Pip Scalper is how you can download three different custom settings files. Check out this guide on the custom settings.

These custom settings are designed to optimize trading results for $100, $1,000, and $10,000 trading accounts, respectively. We recommend checking out these custom settings because trading can be quite profitable with them.

EA Pip Scalper Cost

The other thing you need to know about this app is how much it costs, which is a very reasonable $399. Keep in mind that other legit trading apps of this kind usually cost many times more than this, usually up to $1,000 or even as much as $2,000.

Moreover, that $399 is a single one-time payment, and once you purchase the software, that copy is yours for life. Realistically, you can make that $399 back with just a few winning trades.

Making Money with the EA Pip Scalper

As you can see, whether you are a professional or a newbie, and whether you just don’t have the time to trade or don’t know what you are doing, the EA Pip Scalper FX autobot can be used by everybody.

It’s a super efficient, user-friendly, and profitable automated Forex trading bot, one that actually produces real profits.

If you have not yet tried using it, we would definitely recommend doing so. Once you try out this particular piece of trading software, you will never go back to manual Forex trading again.