Insanely Lucrative Crypto Trading Signals

Insanely Lucrative Crypto Trading Signals

GET YOUR TRADING SIGNALS HERE!

The Profitable World of Crypto Trading Signals

Experienced traders and advanced algorithms generate signals that provide insights and recommendations for buying or selling cryptocurrencies. The controversy surrounding these signals is due to skepticism about their accuracy and reliability. However, many success stories have shown how individuals have transformed their lives with these signals. The key to their profitability lies in analyzing market trends, technical indicators, and fundamental factors. Traders use various strategies, such as trend-following, momentum-based, and contrarian approaches, to maximize returns. Staying updated with the latest news, monitoring charts, and evaluating risk management techniques are crucial for making informed trading decisions. While there are no guarantees in the volatile world of crypto trading, following expert advice and using profitable crypto trading signals can greatly increase the chances of success.PROFITABLE INCOME MENTOR BOX CRYPTO SIGNALS!

The Income Mentor Box’s Cryptocurrency and Forex trading signals impress due to their consistent profitability. Last week, between November 6 and November 10, a total of 25 VIP signals were released for both markets.

Strikingly, 21 of these signals hit their profit targets, while only 4 reached stop loss levels.

Strikingly, 21 of these signals hit their profit targets, while only 4 reached stop loss levels.

This exceptional performance reflects an astounding 84% success rate, with the 21 winning trades generating an astonishing 1633.21% in profits!

This exceptional performance reflects an astounding 84% success rate, with the 21 winning trades generating an astonishing 1633.21% in profits!

Exploring the Controversy Surrounding Crypto Trading Signals

Crypto trading signals are popular for their potential to deliver high profits. These signals, generated by experienced traders and advanced algorithms, analyze market trends, indicators, and fundamental factors to identify profitable opportunities. Traders can take advantage of these signals to enter or exit the market at the right moment and potentially maximize their returns. However, there is controversy surrounding the reliability and accuracy of these signals due to the volatile nature of the cryptocurrency market. Traders should conduct thorough research, evaluate signal providers, and understand the risks before following any signals. Despite the controversy, there are success stories that demonstrate the potential of crypto trading signals. Many individuals have turned small investments into massive profits using these signals. These success stories emphasize the importance of analysis, risk management, and choosing reliable signal providers. It is important to note that these stories are meant to inspire and not guarantee success. Each trader’s experience may vary, and the cryptocurrency market can be highly volatile. However, these stories show the opportunities that can arise through cautious and informed decision-making when using crypto trading signals.

Unveiling the Secret Strategies Behind Profitable Signals

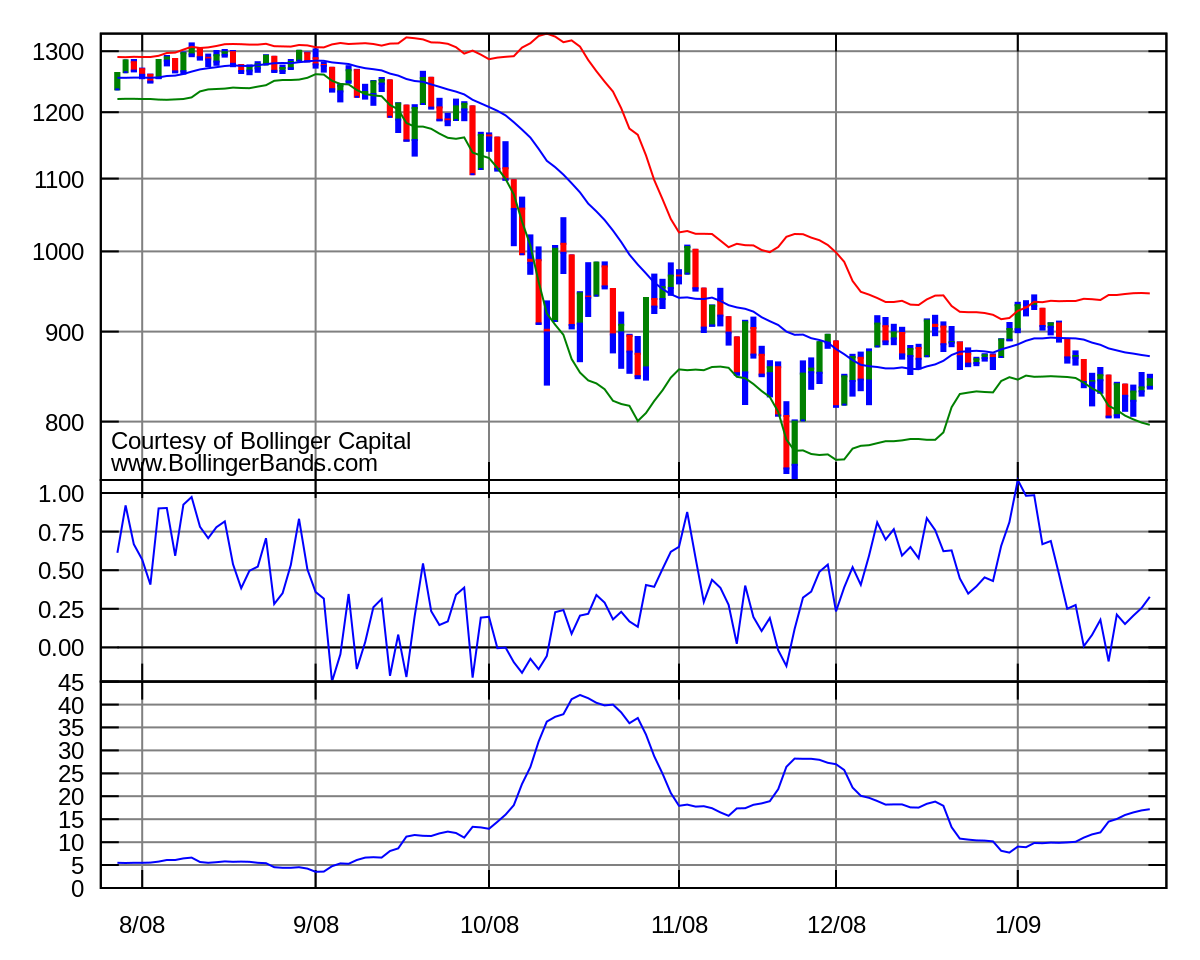

Profitable crypto trading signals are backed by secret strategies that can greatly impact a trader’s success. These strategies involve comprehensive market analysis, including technical analysis of price charts, candlestick patterns, and indicators like moving averages or Bollinger Bands. Fundamental analysis also plays a vital role in identifying potential market catalysts and news events that can affect cryptocurrency prices. Traders also use risk management techniques, such as setting stop-loss orders and maintaining a diversified portfolio, to limit potential losses. The combination of technical and fundamental analysis, along with proper risk management, forms the basis of these secret strategies. Timing is crucial when executing profitable crypto trading signals. Traders use advanced tools and technologies to receive signals promptly and act quickly. Automated trading bots can be used to automatically execute trades based on predetermined parameters. Some traders also rely on community-based platforms where experienced traders share their signals, increasing the chances of success. Additionally, timing strategies involve closely monitoring market conditions and executing trades during periods of high liquidity and volatility. Mastering market timing, along with the secret strategies of thorough analysis and intelligent risk management, can unlock the potential for consistent profitability when trading with crypto signals.

Insider Tips for Maximizing Returns with Crypto Trading Signals

Successful traders often attribute their achievements to the careful selection and implementation of secret strategies behind profitable signals. These strategies involve a comprehensive analysis of market conditions, including technical indicators and fundamental factors that can impact cryptocurrency prices. By considering both technical and fundamental analysis, traders can gain a holistic understanding of the market and make informed decisions. Furthermore, implementing effective risk management techniques and diversifying portfolios can help mitigate potential losses while maximizing returns. It is essential to stay cautious and well-informed when using crypto trading signals, as market conditions can change rapidly. With proper research and a sound understanding of these secret strategies, traders can enhance their chances of attaining consistent profitability in their crypto trading endeavors.

How Crypto Trading Signals Changed Lives

Lucrative crypto trading signals have revolutionized investing by providing traders with valuable insights and opportunities to maximize profits. These signals use advanced algorithms to predict market trends and identify potential buying or selling opportunities. By following these signals, traders can make well-informed decisions and capitalize on profitable trades. These signals filter through vast amounts of data, identify key patterns, and generate actionable recommendations. Investing in cryptocurrencies can be volatile and unpredictable, but with lucrative crypto trading signals, traders can navigate the market more effectively. These signals provide accurate and timely information based on thorough market analysis, helping traders capture profitable opportunities while minimizing risks. It’s important, however, to consider the signals provider’s track record, performance consistency, and signal reliability. By incorporating lucrative crypto trading signals into their strategies, investors can increase their chances of success and potentially achieve substantial gains in the volatile world of cryptocurrencies.

Takeaway

Cryptocurrency trading, a domain veiled in mystery and volatility, has emerged as a lucrative venture for daring investors. With the relentless ebb and flow of virtual currencies, the quest for profitable signals becomes paramount.

But beware, for the realm is fraught with misleading whispers and treacherous pitfalls. Amidst this frenzied landscape, a select few have mastered the art of deciphering the enigmatic patterns that dictate market movements.

They wield their knowledge like sorcerers, unveiling hidden pathways to unimaginable wealth. These cryptocurrency wizards, armed with their trading signals, have amassed fortunes in the blink of an eye while leaving the common traders yearning for their ethereal guidance.

Their signals, a mystical concoction of technical analysis and market intuition, carry promises of untold riches. But tread lightly, for even the most seasoned practitioners can falter in the unpredictable dance of the crypto world.

As dreamers chase the allure of astronomical profits, the most profitable crypto trading signals serve as beacons of hope in this turbulent sea of uncertainty.

CLICK BELOW TO JOIN IMB 2.0

/dotdash_INV-final-Bollinger-Band-Definition-June-2021-01-518977e3031d405497003f1747a3c250.jpg?resize=794%2C446&ssl=1)

/BollingerBands-5c535dc646e0fb00013a1b8b.png?resize=483%2C362&ssl=1)

:max_bytes(150000):strip_icc()/SMA-5c535f2846e0fb00012b9825.png?resize=465%2C273&ssl=1)